This post is Part 2 of our four part series on What It Takes To Go from 0 to 1.

Let’s say you’re at 0 and you’re thinking about starting a company. You’ve got an idea.

The first thing you need to do—if you’re committed to going down the path of venture financing—is to figure out if you are in a big enough market for venture financing.

If you’re not in a big enough market, and you go down the venture path, the money will unfortunately end up hurting you. Your company won’t scale with the capital, even though you might have built a great company if you hadn’t fundraised.

There are a few ways to go about determining if you’re in a big enough market. One is a bottoms up analysis. But, as you may have heard, if you’re creating a new market, like Airbnb and Uber, you really won’t know how big the market is. These companies are typically the ones that turn out to be “unicorns.”

From what we have seen, the one thing that such companies all have in common is that the founder has great ambition. They don’t just want to make a quick exit or a lot of money. They want to fundamentally change something that they think is broken, or they just really want to make it big.

There’s a fire in them, and it shows in their presentation. To be honest, there is a little, “We know it when we see it,” but we’ll try our best to describe what it looks like here.

The Difference Between a Good and Great Founder

So, let’s assume a company comes to us, and they’re pre-seed. Maybe they don’t have a product yet, and they want to sell lead gen software for real estate brokers.

A bottoms up analysis would sound like this: “We’re going to be able to charge people $5 a month. There’s about 2 million real estate brokers in the US, so we’re going to hit 120 million in revenue in a given year if we sell to everybody.”

We’ll know immediately that that’s a small company, because you have to sell to everybody, and we would need an 8x multiple to get to 1 billion.

Of course, no smart founder would come and show us that. They would probably say something more like, “I’m going to charge $50.” Then the numbers get bigger, which looks nice, and then it’s our job to figure out if we believe that you’re actually going to be able to charge $50. We’ll ask questions around that. But at least now we know it’s a big market.

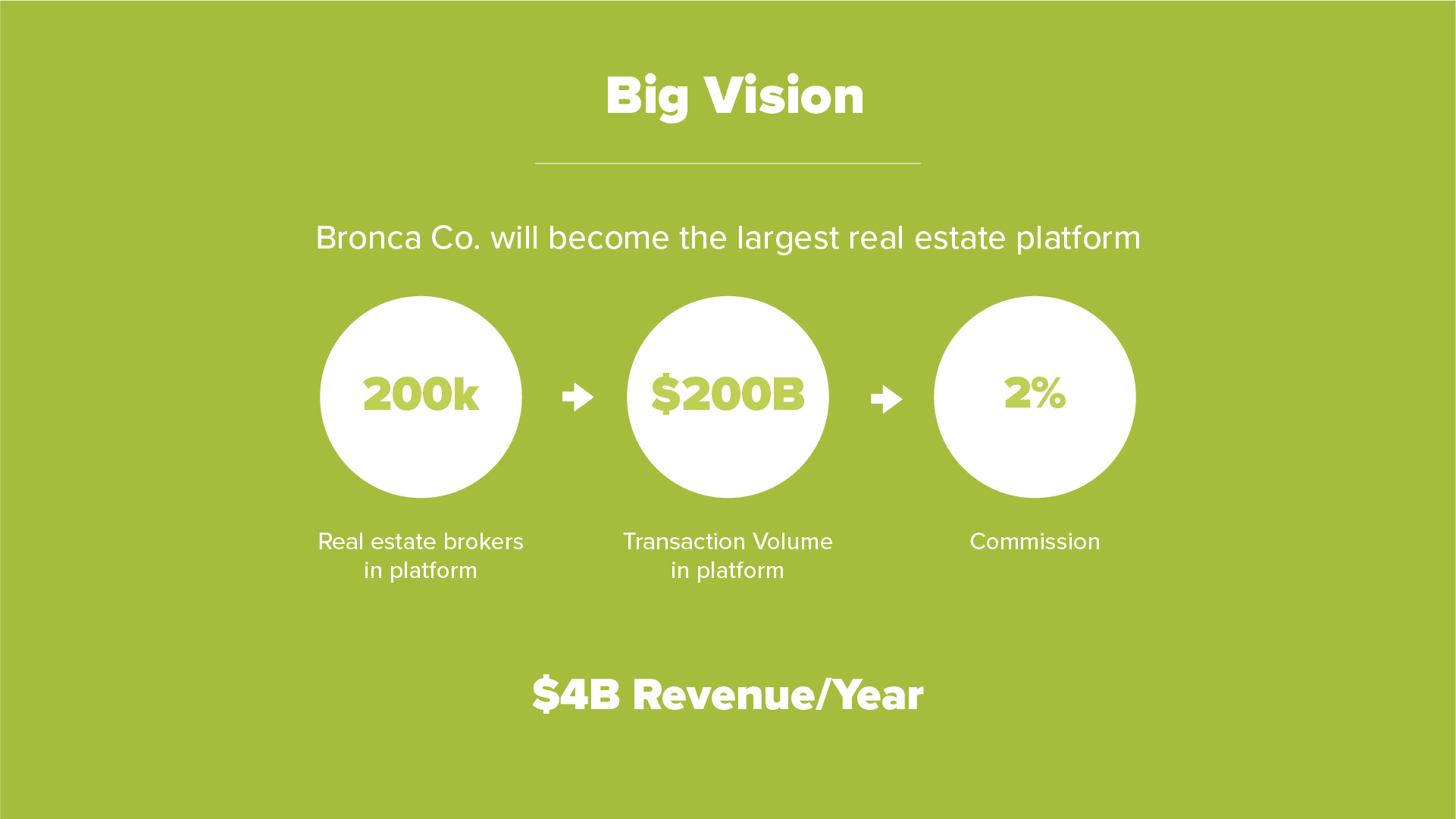

The CEO’s of a potential “unicorn,” however, approach this differently. They say something more like, “Listen, real estate is broken and I’m going to build a marketplace where most transactions happen. Maybe I’m going to build a SaaS enabled marketplace and I’m going to sell some software, but fundamentally, I’m going to take a percentage of all the transactions in real estate.”

We start thinking: “Hey, we want to back this person, they’re going to change real estate. They’re not just selling a tool to somebody.”

We’ll admit this is very subtle, but it’s critical because it determines what type of company you can become.

The point is, if you want to start this path, your ambitions need to be big.

When we see a founder with ambition of this scale, our job is to figure out if we believe that this person can attract the talented co-founders and early team members they’ll need to execute and actually achieve those big ambitions.