This post is Part 4 of our four-part series on What It Takes To Go from 0 to 1.

Let’s assume you’re a SaaS company that’s now raised some seed money. You’ve raised from us and you have two customers, and the founder has done all the sales.

Now your task is to prove two things:

- someone who is not you can sell your product

- you can optimize and scale that process

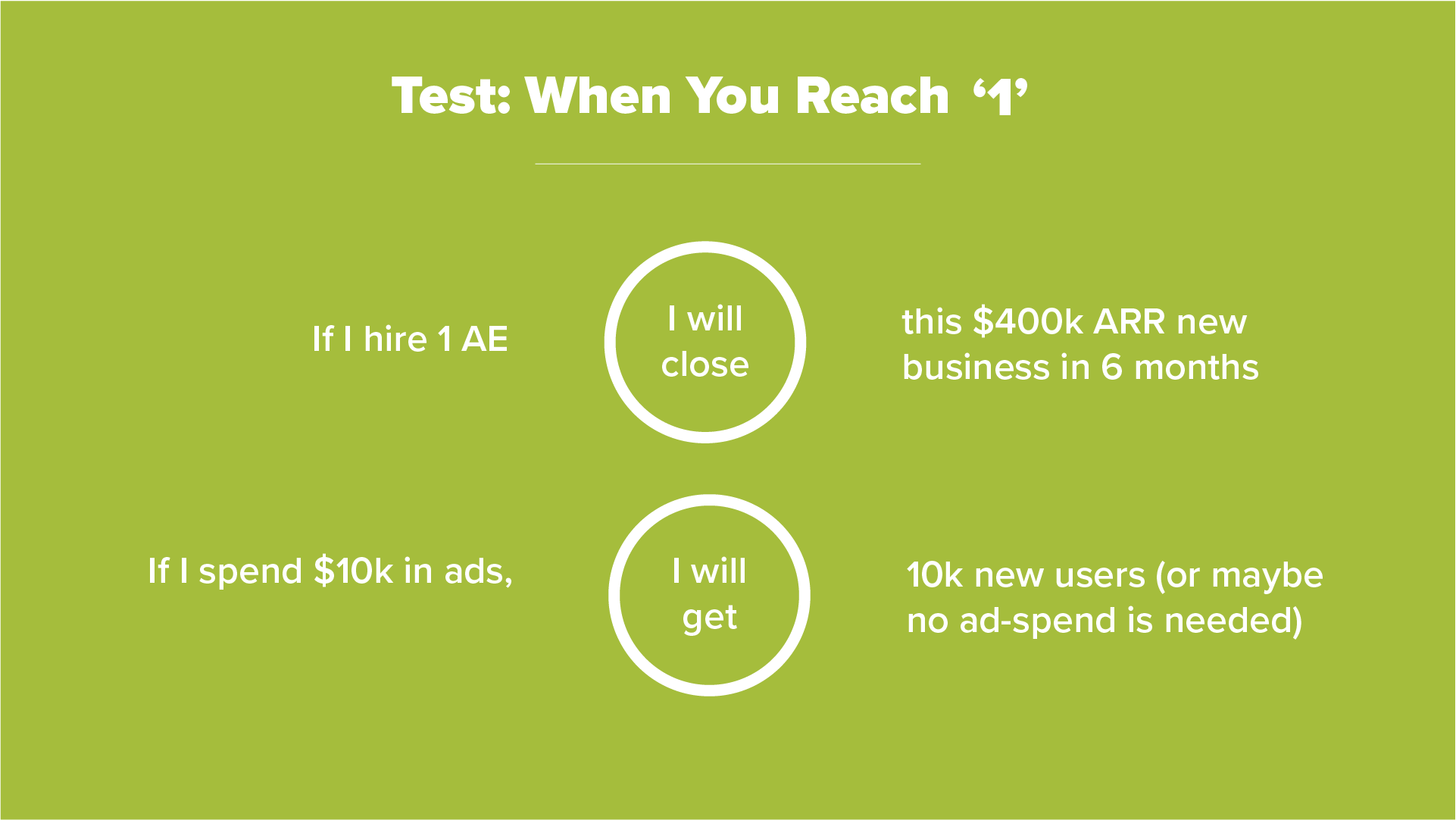

This usually involves building a sales team or setting up a reliable marketing channel. The test for this stage is whether you have a reliable formula for your growth. That is, you should be able to confidently say, “if I do X, I will get Y new customers / users / revenue.”

Pure growth is not enough. You can be growing super fast, but if you have no retention, we know that growth will die. Again, you may be tempted to buy a bunch of ads right before your raise to spike your growth for two months, but smart investors know that that’s not real growth.

You may be surprised to learn that pure revenue is also not enough. We have found that post-money valuation of series A companies and their monthly recurring revenue is not correlated at all:

If product love is the one thing that matters most to us at 0.5 stage, what is it for the 1 stage? That you’re going to be a “big company.” We are looking for predictors of success. You can think about it as the “second derivative” of your growth.

In this stage, we want to make sure that people not only love your product, but that they love it enough to pay you enough money to make it profitable to grow.

Even if you’re at only 200K in MRR, if we can see that you’ve gone from one person using your product to 20 people using your product, and those people are using you every day and they can’t live without you, you’re probably a great company, like Slack! They didn’t need to have 1 million in ARR for investors to know that people loved that product and that it was going to stick around.

Series A investors are going to look at your scale metrics, like LTV (lifetime value) to CAC (cost of customer acquisition).

To get to Series A from the seed stage (or from 0.5 to 1), the most important thing you need to do, as a seed founder, is to make a plan and measure your progress. Determine where you want to be in four quarters, then walk backwards and figure out what you need to achieve that.

Look at everything you need to do.

For example, if you want to be at $1 million ARR, with some amount of cash for six months at the end of Q4, you might determine that you need to hit $100K in revenue by Q2. You probably are also going to need enough leads by Q2. If this is a SaaS business, you may want to hire a salesperson for that. And if you have all these customers, you’ll likely want to support them and keep them happy, so you might have to hire a customer success person in Q3. To have something to sell in the first place to get to that Q2 revenue, you might need to have an MVP by the end of Q1 that requires hiring a certain amount of engineers.

You’ll need to do all this math to find out what that plan all costs and how much cash you need to have for it. It is likely you’ll need to iterate on this plan, which is why you also need to measure everything as you proceed. What gets measured gets done, and the bonus is that it’s easier to measure things at the seed stage! We love data driven CEO’s, and we even encourage founders to display their key metrics to everybody in their company. When you go out to raise our series A, you can just take your dashboard to the investors!

Once you have a plan, and you have your measurements, you’ll need to put those two together to figure out whether you’re on track or not. This sounds very simple, but we’ve had many founders suddenly call us with three months of cash left out of the blue. Force yourself to send reports to yourself, to your team and to your investors. When you do that, you’re actually committing to something, and that makes you true to the plan.

Here at Pear, we make every one of our seed companies run through a planning exercise at the very beginning of our partnership with them, and we review the plan every quarter. When our founders are in trouble, we review it every week, so we can figure out what our goals are and what we need to hit.

Final Stretch: Don’t Mess Up the Actual Fundraising

Fundraising is a little like selling a house. If you’re trying to sell a house, but you don’t have your inspections complete and you haven’t cleaned up the lawn, you’re probably going to get a lower final price than if you’d done all your work—even if you’ve got a great house!

Put another way: no matter how great your numbers look, you still need to have a great pitch. You have to actually communicate with data. You have to have a rational ask.

Remember, there are much fewer Series A funds out there than angels and seed funds, so the stakes are higher with each meeting, and it’s much slower and more complex. You can’t hand wave. You need to have concrete, quantitative answers, and investors are going to take several weeks to get back to you. It could take longer. The good ones do it fast, but it’s not 30 minutes.

Also, think through your process. Don’t contact 20 series A investors at once with your initial pitch. Stagger your pitches so you can iterate and revise between each, and save your top choice investors for last, after you’ve gotten feedback from the others.

This brings us to our final piece of advice for this process: diligence who you work with! We’ve seen founders get desperate and take money from investors they shouldn’t. We’ve done that personally on our own entrepreneurial journeys. It’s absolutely painful. You have to know who you’re fundraising from.

If you’re considering us as partners on this long journey, we hope you’ll take the time to get to know us, just as much as we promise to take the time to get to know you.