How active are investors? What are you seeing at Pear? How do you reconcile competitive rounds with lower valuation and less activity? How do I know if I should raise now? How can I show that I am a good company? Are investors looking at metrics and indicators differently? How should I build a plan? Is this a good time to *start* a company? Bottom Line

Alongside our founders in the past few weeks, the Pear team has been figuring out how fundraising now “works” in our new world. While taking meetings over Zoom, we inevitably get urgent questions like these:

- Are you still funding start-ups? How active are investors? Are they looking at metrics and indicators differently?

- Are valuations lower? Any trends on where valuations are going?

- What are you seeing at Pear in terms of seed-funding right now?

- Is this a good time for me to fundraise? Should I wait until 2021?

Here’s what we know so far, two months into shelter-in-place in the Bay.

As with any COVID related advice, there is still a great deal of uncertainty out there and things are changing very quickly day-to-day. Our answers here are intended as extra data points to help your decision making.

How active are investors?

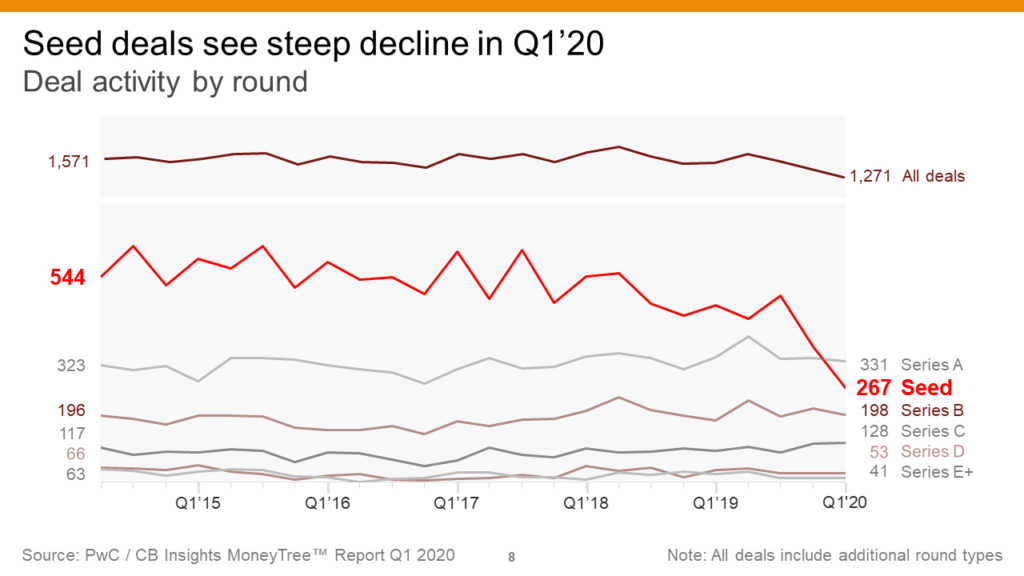

Early data from Q1 suggests investment activity is down (note: this only includes 2–3 weeks of US shelter-in-place).

- Crunchbase Q1 2020 Global VC Report: dollars invested quarter over quarter dropped 27% (includes angels, pre-seed and seed deals)

- CB-Insights Research Brief April 2020: seed deals are down 27% from Q4’19 and 43% from Q1’19, but median seed deal size is staying flat at $2.4M

- Axios: “Investment activity is off approximately 25% from pre-pandemic levels” (according to April & May Pitchbook data)

Although the last 25% drop number seems bad, you can interpret it another way: investment activity in April 2020 was not zero. It was 75% that of April 2019 and that’s still a big number (~$2B per week). So, if you are a founder, know that venture capitalists are still investing.

Financing rounds are taking longer to close. NFX put out a survey comparing the opinions of VCs and founders on the current financing climate. A whopping 88.5% of founders reported that VCs were slower in responding or not responding at all. However, note that in early April, most of us were busy with our portfolio. We would guess that if the survey were run today, the 88.5% number would be lower.

Good companies are still raising money. Just in the last eight weeks, very large growth financings have been reported, such as Robinhood and Carta and of course, the ultra-competitive $12M seed round of Clubhouse.

What are you seeing at Pear?

- Investments feel less rushed, though our own sample set is small, and we are still moving fairly fast.

- Valuations are a bit lower but we still don’t have enough data around valuations. We have many investor anecdotes, but we will not have statistically significant data until the end of the Q2 when financial data companies, law firms and others publish their results.

- Great companies are still getting multiple term sheets. Some of our portfolio companies have multiple Series A term sheets, with competitive terms and valuations similar to those of early in the year. We have also been involved in competitive Seed financings — where we’ve gotten our own taste of how hard it is to pitch yourself via Zoom!

How do you reconcile competitive rounds with lower valuation and less activity?

This is what is happening.

Investors all have a certain bar in terms of committing to an investment, but we are also all very different. One investor may absolutely care about unit economics, while the other one is more focused on team or absolute revenue.

Back in January, in the midst of the “good times,” a company with only a few of these good attributes could have had an easy time getting to a competitive financing. Today, the bar for getting to a yes from an investor has come up (we have noticed that the very best investors tend to always have a high bar).

So for you as a founder, it means the following: adjust your bar. If you are a great company you will be able to raise money at good terms.

How do I know if I should raise now?

This advice is fundamentally driven by the company’s health. We have given advice to our portfolio ranging from “raise money now” to “it would be suicide to fundraise now.” The company’s health may be affected by COVID-19 but ultimately it will go back to those “good company attributes”: positive unit economics, efficient growth, short payback times, a team that can execute, a big market opportunity…

This coming recession has not affected everyone equally. Some companies have been badly hit and some have benefitted, and some are in the middle. Depending on where you are, you may want a different strategy. Here are some scenarios:

(1) You are in a terribly hit space like travel or retail. No matter how great your business was, your business is zero now, and it will be hard to fundraise. If you have to fundraise, you should be ready to accept lower terms than your last round (e.g., Airbnb). If have cash and can weather the storm, cut costs to a bare minimum and wait for the market to come back. If you don’t think the market can come back, you need to change what you are doing.

(2) You are in a market with tailwinds and your business is blowing up, like online education or remote work. This may be exactly the right time to go out and get some capital to scale. In this situation, we believe that even if your unit economics and growth efficiency are not great, you can still fundraise easily (maybe not from the top, but there is still a lot of FOMO).

(3) You are in the middle scenario—your market is not terrible but not great. You are expecting your top line revenue to go down ~10–35%. You will need to do a bit more homework. Cut costs, focus on building your product and on improving unit economics and growth/sales engine efficiency (see this Sequoia post on targets for building a new plan). Ideally you have enough cash to make your company more efficient and show a couple of quarters of growth before you need to go out fundraising.

Remember, good companies can always fundraise, so the question can be turned into — “How can I show that I am a good company?”

How can I show that I am a good company? Are investors looking at metrics and indicators differently?

The metrics that matter don’t change: big market, strong unit economics, efficient growth. You can read more about this in Mar’s deck on the seed landscape in 2019. Good investors know that it is always a good idea to invest in these structurally good companies.

Showing some growth is still important. You will definitely get a break on not hitting your pre-COVID growth numbers, but you won’t get a free pass. It is important to show that you have quality growth (even if it is still small).

How should I build a plan?

It is absolutely crucial that you are aware of the macro-situation. If you are following the situation online, you know that nobody knows what will happen with certainty. Everything depends on how the population behaves or whether we will have new therapies or a vaccine.

You need to tell us investors that you are ready to succeed in the event of the worst-case scenario. For example, if you are a travel company counting on the market to rebound in July and you show a straight curve to the right, we will likely question it.

We want to know that you have a plan in case there is a second shelter-in-place. We want to back founders that are aware and a bit paranoid. Don’t just say “We are through with the worst” or “People will start traveling again soon, no problem.”

Is this a good time to *start* a company?

The short answer is yes.

There will be long term effects from being sheltered at home for 60 days. It has already affected all industries: consumer, industrials, retail, medicine, enterprise… It has affected all of us individually and we have become accustomed to new ways of living. We will be more open to remote work, telemedicine and home deliveries.

We see this as a great opportunity for a founder to build a company that takes advantage of this mindset and behavior change. As a seed company, you can spend the next two years plotting the ideal product that takes advantage of this new macro.

Recently a founder told us, “I can’t get a corporate job now — I need to continue to build my company. There is so much opportunity now to create new defining companies.”

This is the founder we want to back, the founder that cannot wait to build companies.

Bottom Line

Things seem to have slowed a bit, but the good companies are still raising money (competitively) and we are not seeing many changes in the valuation.

As a founder, focus on building a company with strong unit economics and efficient growth. This is true always, but it will ring even truer now.