Honey Homes, closed their Series A recently, led by Khosla Ventures and supported by Pear and others. To mark the occasion, we thought we’d do a little lookback of our history working with the Honey Homes team over the last few years.

We were first introduced to Honey Homes’ Founder and CEO Vishwas Prabhakara through DoorDash alums, including Evan Moore. The Khosla team knew that the Honey Homes team had a promising early idea and felt Pear would be great seed partners in shaping it into a venture-scalable business.

Once we met the team, we were excited about backing them for a few key reasons:

- First of all, we knew this was a massive and unsolved market opportunity. US homeowners spend $250 billion annually on their homes via a highly-fragmented vendor network. The Honey Homes team saw a big opportunity to streamline that network and create a product experience that has never existed for home owners. Most home services companies are marketplaces or managed marketplaces, so it is challenging to make the economics work and keep the quality bar high while scaling. This results in churn from both the supply and demand side. Honey Homes saw an opportunity to do things differently and build out a new model – a homeowner subscription business where they employ handy people. This changes the economics and raises the quality bar substantially.

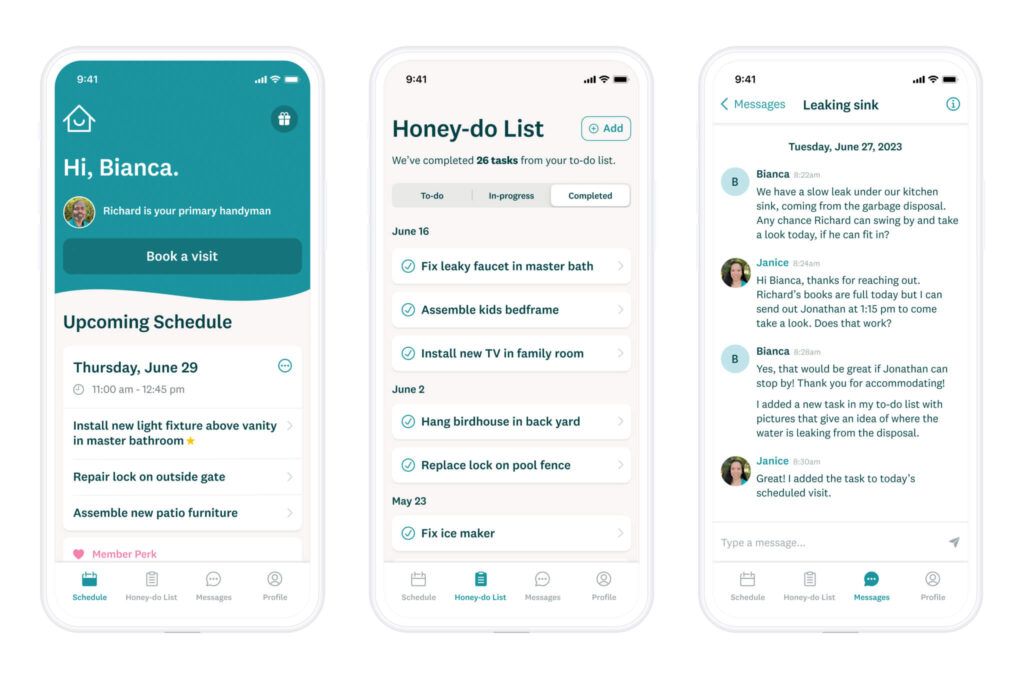

- Secondly, they had a clear vision for a product to meet that market demand. The Honey Homes team wanted to build a membership service for busy homeowners to manage and complete to-do lists. I was a new homeowner myself at the time, could easily relate the never ending list of tasks to maintain my home and the difficulty of finding and keeping handymen. I found the idea of a reliable membership service really enticing.

- Finally, we felt that the team was really strong and perfectly suited to tackle this problem. Vishwas was Yelp’s first General Manager and he was also COO of Digit, where he gained valuable experience as an operator. He understood first hand the piecemealing that homeowners have to do for maintenance and improvement work. Avantika Prabhakara, who leads Marketing at Honey Homes, has a rich marketing background from organizations like Opendoor, Trulia, and Zillow, so she’s also deeply familiar with the challenges people face on finding reliable contractors and handyman services.

Khosla and Pear co-led the seed round in July 2021. Over the last two years, they’ve focused on building out the infrastructure to make this service work, growth in their initial markets, and eliminating key risks in order to raise their Series A. They grew from just a co-founding team to 12 employees and 14 handymen during this time. They also expanded across the Bay Area and Dallas and onboarded 500+ subscription customers. In total, over 20,000 home tasks have been completed for members through more than 10,000 Honey Homes visits over the last two years.

I’ve been lucky enough to not only be an investor into Honey Homes, but also an early customer. I started using Honey Homes in March 2022, and I’ve had hundreds of tasks completed in my home ranging from fixing a frustrating leaky pond to helping us move our furniture to fixing water-damaged cracks in our ceiling to cleaning out dryer ducts. We use the service so regularly that even my daughter knows our handyman, Miguel, by name. Honey Homes has had an incredibly strong customer response: everyone who hears about it wants to join and they’ve done an excellent job retaining customers.

We’re so proud of the team for successfully raising their Series A and cannot wait for their continued growth and success!