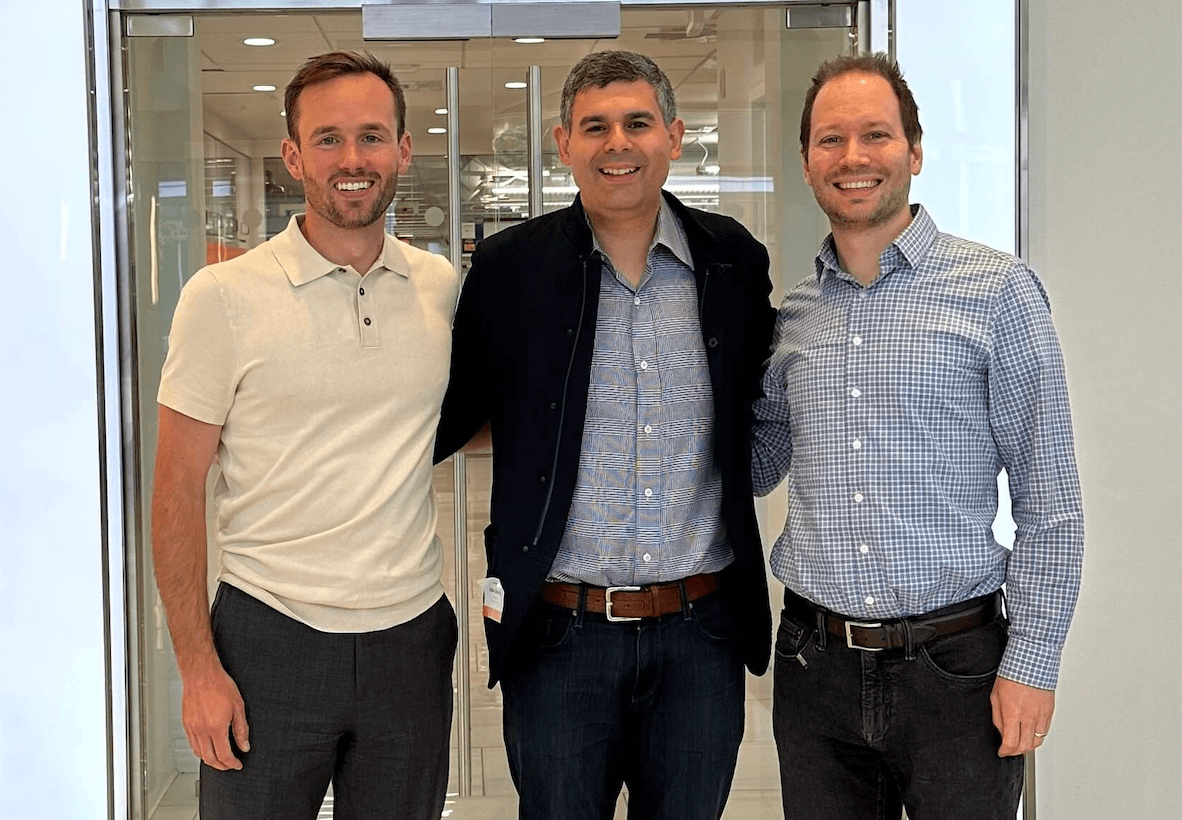

PearX alumni company, Via, just announced that they’ve been acquired by Justworks. To mark this occasion, we wanted to share a look back on how we met and worked with the Via team over the years.

Mar first met sisters and Via co-founders Maite and Itziar when they were students at Stanford’s Graduate School of Business. They were enrolled in the Launchpad d.school course where Mar was a guest lecturer. Through the class, they developed an idea to build a marketplace to connect top professionals to short-term project work at different companies around the world. They built strong conviction through the course and we thought they were the perfect fit for as founders of these companies. We invited them to join PearX, our early-stage bootcamp for founders, and partnered with them from then on to build Via.

We decided to partner with Maite and Itziar for a few major reasons:

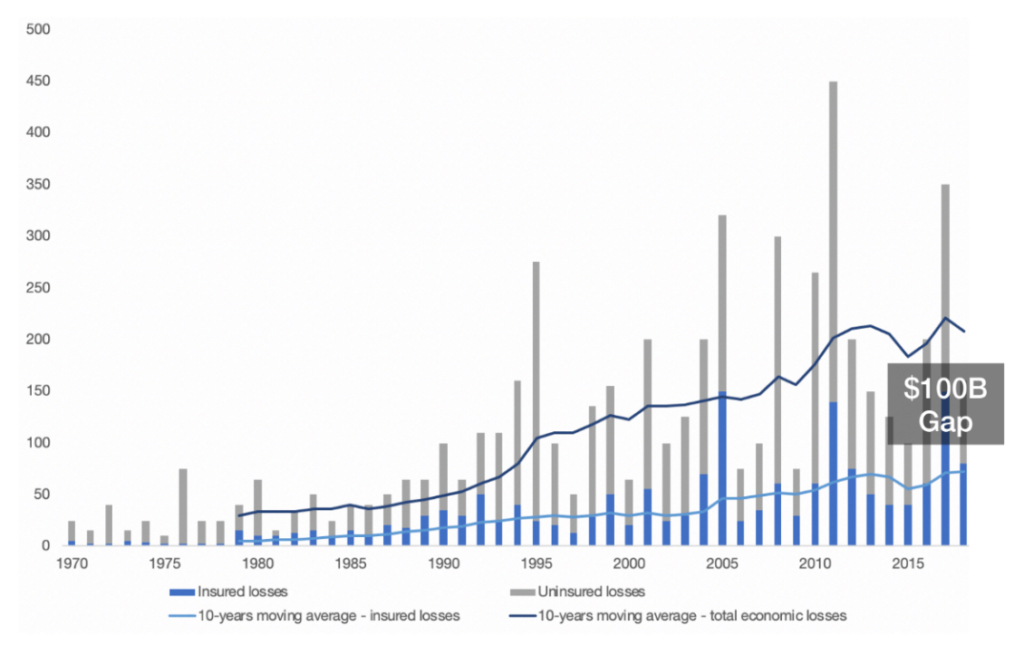

We saw a big market opportunity:

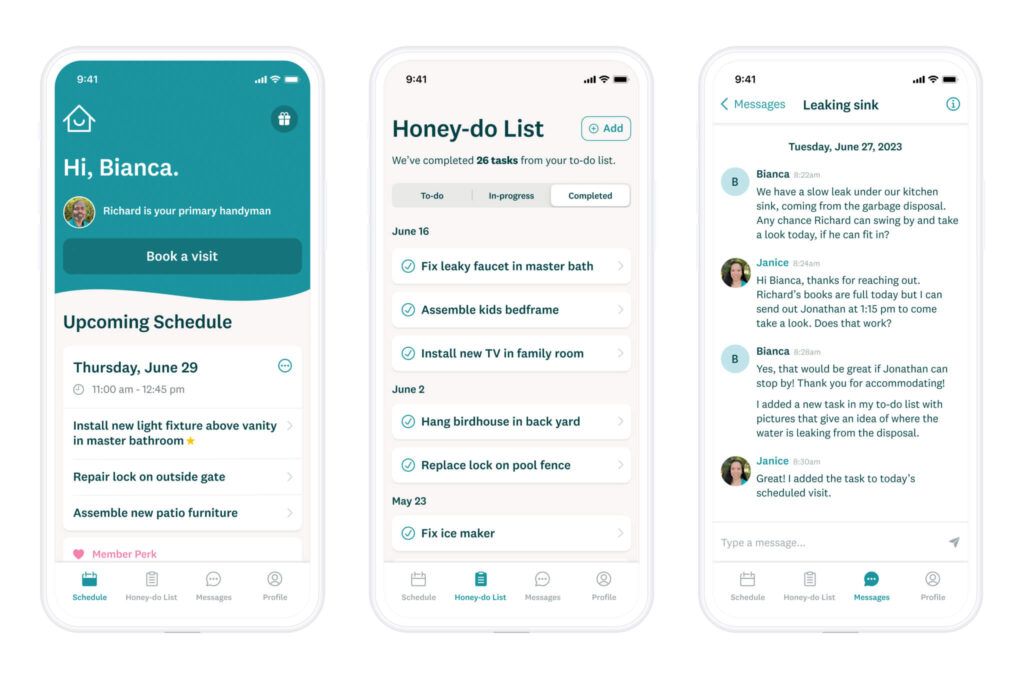

The Via co-founders discovered that there was a massive multi-billion dollar need for hyper local employer of record (EOR) and native payroll services for companies in international tech hubs. Through research, they learned that, when companies hire internationally, they typically do so via contractor agreements, but this happens without any truly scalable benefits, compliance, or payroll services. This works for companies that are hiring a small handful of employees in international markets, but it breaks down for companies that are hiring at scale with dozens or even hundreds of employees. Via saw a big opportunity to make that easier for these larger companies.

Strong ability to execute:

After seeing the big market opportunity, the Via team focused on building a product that met that need. They built deep infrastructure in over a dozen large, international markets, allowing Via to provide the right level of service to multinational Fortune 500 customers. Companies no longer had to spend years laying down the foundation to open a new hub, they could partner directly with Via and launch their new offices in a fraction of the time. They were quickly able to attract a number of top professionals to join companies internationally. We realized the cyclicality of this business model, and at the same time, they were hearing from their corporate customers that there was a big challenge in hiring employees internationally. Starting a new hub in a different country was desirable for many reasons, but payroll, insurance, benefits, and compliance all become very complicated, which prevented many companies from starting international hubs.

The founders were the right ones to tackle this:

The sisters and co-founders, Maite and Itziar, were the perfect duo to start and run Via. We loved the team because of their deep understanding of their customer’s pain point and their international focus. They are both GSB alums and brought deep business experience to the table: Maite has a background in investment banking at JP Morgan and Itziar was Head of Strategy for Citi Fintech. They also worked in markets like Argentina and Mexico, so they understood the pain points of hiring internationally.

Via’s work became even more relevant in a post-pandemic world, where there has been a big rise in companies hiring internationally. Put simply, they’ve become the best choice for Fortune 500 customers. This acquisition by Justworks makes sense: together they can offer the Via service at scale.

We are proud of their journey. After raising an initial pre-seed round after PearX, they realized that it would be hard to build a venture scale business focusing only on short term job opportunities. We huddled with them and they decided it would be best to pivot to the employer side and solve their problem which was more around building a permanent workforce internationally. Maite and Itziar navigated this pivot with rigor and optimism.

The team then scaled out their hyper-local EOR platform, scaled to millions of dollars in annual revenue, and raised a Series A in December 2022. To date, they’ve raised from an incredible group of investors, including Industry Ventures, Switch VC, Entree Capital, Burst Capital, Pear and more.

Given the infrastructure that they’ve built, it’s no surprise that they had inbound interest for M&A. We think they’ve found the perfect home in the Justworks team. The acquisition by Justworks provides an ideal platform to scale their joint business internationally allowing any company to become a global organization. Congrats to Maite, Itziar, and the entire Via team!