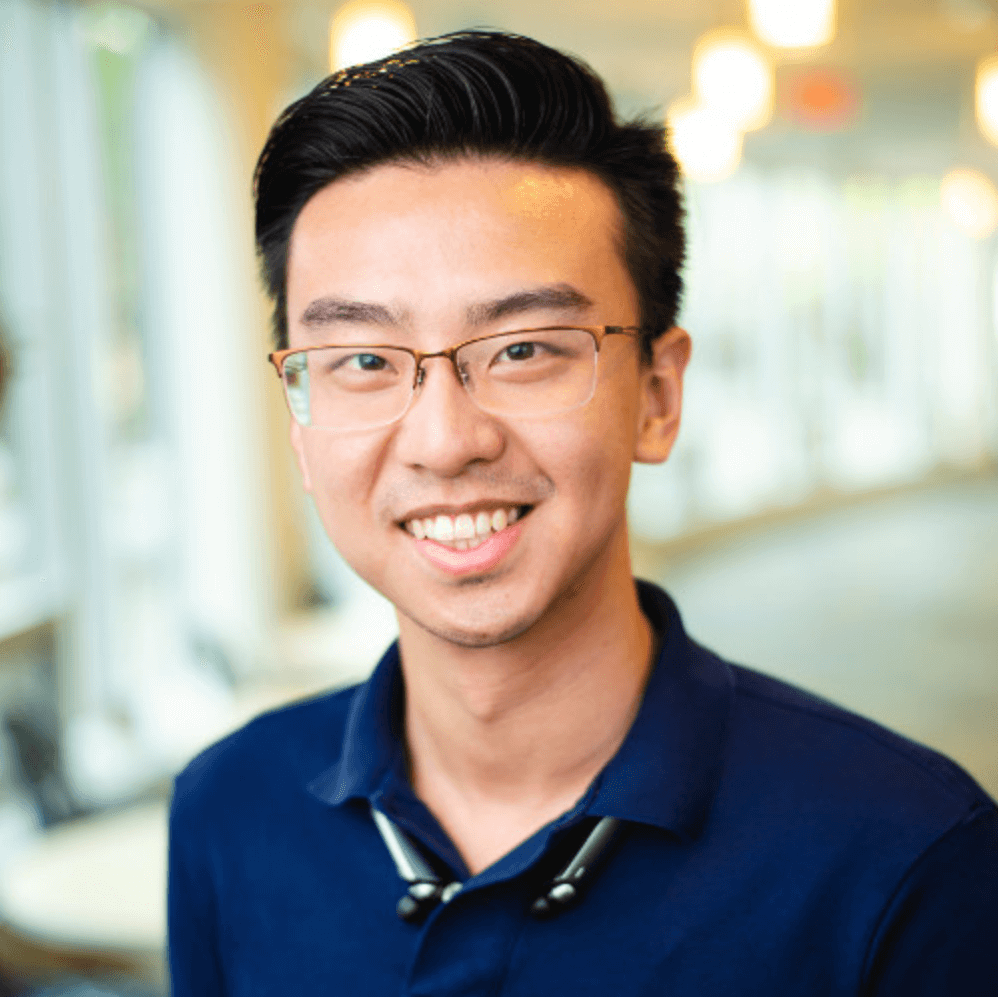

We’re excited to announce that Arpan Shah has joined Pear as a FinTech Visiting Partner! He’s working with Pear companies to share his learnings earned through founding and selling his financial APIs company to Plaid, as well as leading engineering at Robinhood for over 5 years. We’re incredibly glad to be working with him again many years after he graduated from our first Pear Stanford Garage cohort in 2014.

When we started Pear Stanford Garage in 2014, Arpan Shah was among the first 12 members in our inaugural cohort. “There were a few things that I found really fun and exciting in particular: getting a chance to meet with a lot of founders, figuring out approaches to early product, iterating on products, fundraising, timing, team building— the elements which go into starting an early early company. I learned a lot of that through the conversations, talks, and sessions that we had at Garage.” We’re so excited to partner with Arpan as a Visiting Partner and have his support for our Winter Accelerator!

After earning a Masters in Computer Science at Stanford, Arpan joined Robinhood as an early engineer in the founding team. “Pear played a role in that; I really felt like a lot of value could be created by being part of something super early. I ended up joining Robinhood at the time because I felt like finance was a big part of all of our lives,” Arpan says. “I was particularly excited because I’d always found investing to be hard in the US.”

Arpan eventually became the Head of Data Platform and Data Products at Robinhood, leading a team of 40+ engineers and engineering managers. “I helped start the data team there, and I grew that into areas like risk and fraud, growth and marketing, data products like search, newsfeed, various aspects of the crypto product, data infrastructure, experimentation, and data platforms.”

“In October 2020, I started Flannel. I had seen a lot of the challenges of money moving in the US being super slow,” Arpan says. “My co-founder and I really felt like we could make that a lot better by leveraging some of the more modern payment methods that were starting to emerge.” Flannel raised a $6.3m seed from Accel and Index, launched an early product, and last March, Arpan sold the company to Plaid.

Throughout the years, Arpan has been angel investing across companies in investing, insurance tech, lending, financial access. “The thing that I’m hoping to bring as a Visiting Partner to Pear is a lot of my FinTech experience— the network I have amongst FinTech practitioners and entrepreneurs as well as helping inform appropriate methods to grow businesses and partner with companies.”

Arpan’s tips for early-stage founders

Hire for relevant experience in the here and now of what you’re working on.

- In early startups, one of the really important things is to hire for the very near term— trying to solve the problems of the here and now. Early founders often think about bringing in someone who has a ton of experience at really large organizations. Oftentimes, those lessons aren’t super applicable or don’t translate well compared to someone who’s been through this early stage phase of development.

- Engineering leadership is critical to hiring early on. Focus on hiring folks who are high growth; experience is not as important, it’s much more important that they can really, really execute at this stage of the company. If you’re looking for experience, I think the experience that makes a lot of sense is people who have worked through the stage of the company you’re in.

Understand the regulatory landscape of the space you’re operating in.

- If you’re in insurance tech, understanding how insurance regulation works is super important. If you’re in the brokerage or investing space, understanding how FINRA and SEC largely regulate those industries is really important. If you’re in the payment space, understand how the money transmitter licenses or money services business regulations work really well.

- The biggest challenge fintech companies often face, which we did as well, is figuring out how to navigate regulation effectively. A key hire that people often don’t think about is bringing in someone with a background to ensure that their product from the very early stages is compliant. Oftentimes, FinTech founders get tripped up because they think they can move as quickly as a lot of their peers. The “move fast break things” model that people often think they can do in other industries doesn’t quite work as cleanly for FinTech. FinTech founders may need a little bit more patience and understanding that a big part of the landscape is not just the product and how you succeed in getting customers, but also how you succeed in navigating the regulatory landscape.

Find the right partners for the journey.

- People think really carefully about founding teams, but I think it’s also really important to partner with investors who really understand early stage company building. And not every investor does. One of the big aspects about successful alignment between investor and founder is investors who can understand that the early part of the company building process is messy, and so they’re willing to get into that mess with you to help solve those problems with you.

“I’m really, really looking forward to working with founders who are building really innovative products that help expand what is possible here in the US when it comes to financial access or financial products,” says Arpan. “When you look at a lot of the other parts of the world, it’s remarkable how much innovation has happened in the financial landscape over the last decade. I think a lot of people think that we’re in the last legs of it, but honestly, I think we’re just getting started. I’m really excited to see all the exciting innovative stuff people can come up with, especially as newer ecosystems like crypto get unlocked and better infrastructure comes online.”

Connect with Arpan at arpan@pear.vc and on Twitter @arpanshah29!