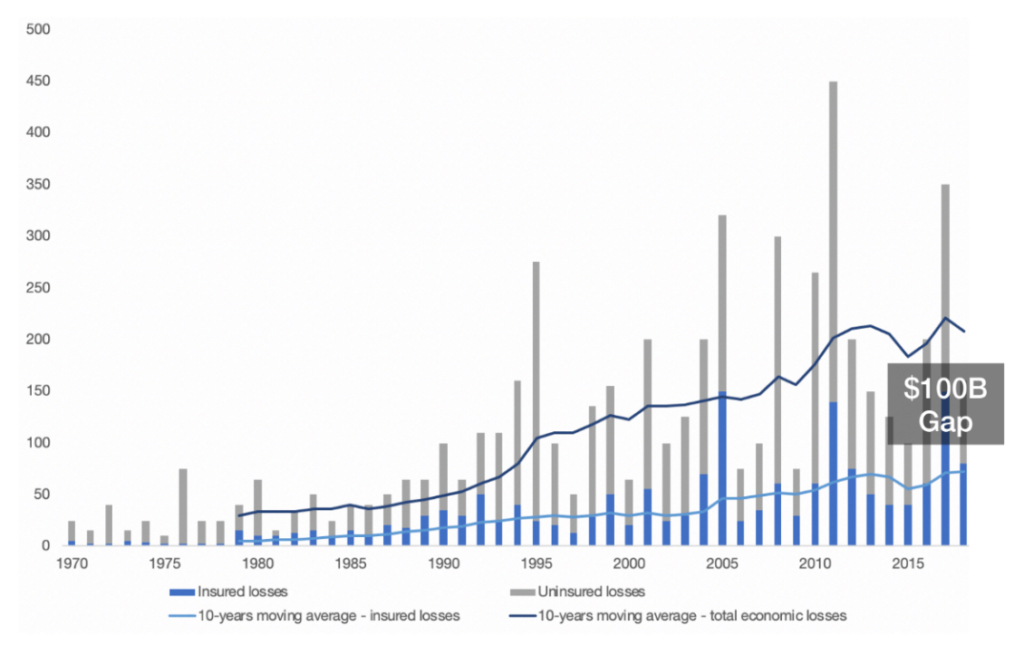

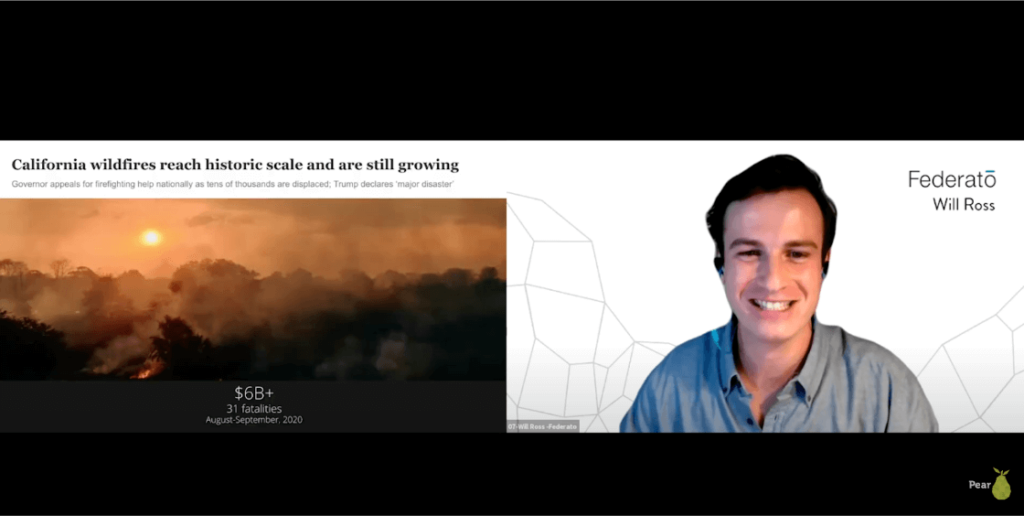

Last month, I had the immense privilege of helping judge Pear VC’s Stanford student Competition. The event highlighted the brightest student founders from Stanford vying for their first check. The Pear Competition has a history of identifying and nurturing exceptional talent, supporting unicorn companies such as Viz.ai and other breakout companies including Nova Credit, Federato, Conduit Tech, and Wagr.

Pre-seed is a notoriously hard stage to invest, as startups often lack any metrics, product, traction, or proven revenue model. The excitement and challenge lies in the ability to identify hidden gems despite the uncertainty, requiring a skillset that combines intuition, experience, and a deep understanding of market landscapes across a wide range of industries.

With the invaluable experience of judging and doing diligence on close to 100 founders alongside renowned investors and proven operators, Mar Hershenson and Ilian Georgiev, I wanted to share 5 key takeaways in pre-seed investing from one of the best early-stage VCs:

1. Passion and Market Insight

Impressive founders had a deep understanding of their market, derived from a unique blend of professional experience, customer interviews, and thorough research. They could clearly pinpoint “hair on fire” problems and delve into pain points along the customer journey in excruciating detail, ultimately laying the foundation for a compelling vision for the problem they aim to solve.

These founders masterfully answered highly nuanced follow-up questions, while still demonstrating a humbling awareness of what they still needed to learn.

2. High Learning Rate

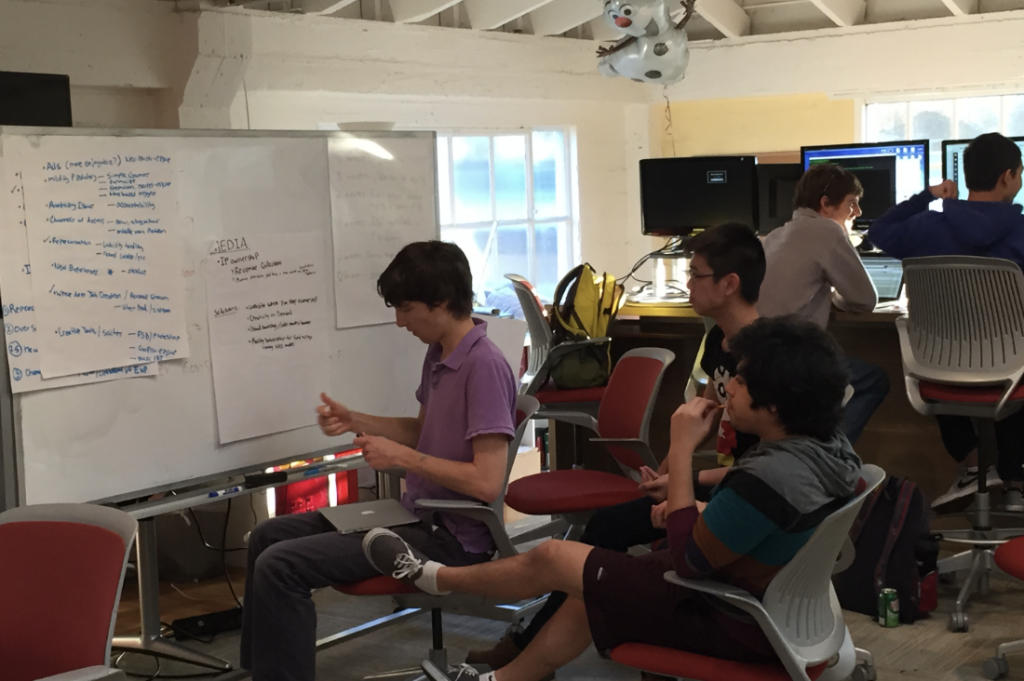

Another exciting key trait of founders was a demonstrated “high rate of learning”. These founders were unafraid to openly discuss assumptions and hypotheses that were proven wrong, providing insights into how their understanding of the market and potential solutions continually evolved. This grounded reflection illustrated their willingness to pivot when necessary, ensuring they could navigate the inevitable uncertainties of the startup journey.

3. Execution Velocity

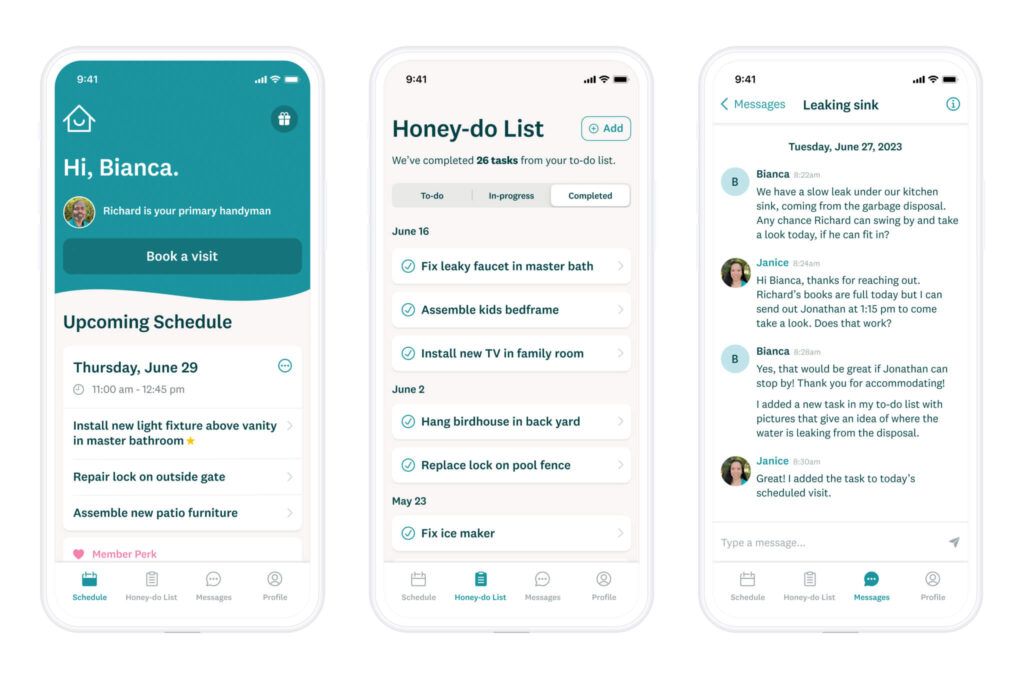

Several founders stood out with their relentless drive to move fast. They leveraged no-code tools, pounded the pavement to connect with customers, and used smokescreen tests to gauge demand. These tenacious entrepreneurs consistently found ingenious, low-cost, and scrappy ways to rapidly test hypotheses, never allowing a single obstacle to halt their progress. They made do with what they had, not waiting on “ideal” resources or the “perfect team”.

4. Commitment

High commitment and perseverance was another trait we looked for in founders. Despite the glamour of eye-catching TechCrunch headlines, the reality is that the founder journey is an uphill marathon. Most startups must navigate the treacherous “pit of despair” for an average of 18 months before achieving product-market fit. A demonstrated ability to weather these upcoming challenging times after the initial excitement fades is a vital asset to tackle the inevitable hurdles of entrepreneurship.

Some of these founders had a history of starting previous businesses, often grappling with numerous setbacks and pivots. They could detail stories of struggles and challenges they faced in their founding journey, demonstrating a balance of grit and determination to continually refine their craft.

5. True Meaning of a “No”

Perhaps the most insightful lesson was that a “no” from a VC often does not mean that the founder or the business wasn’t exceptional. Many factors can contribute to a “no” despite an impressive company, such as a competing investment, the market size, or a mismatch with the VC’s sector focus. Founders often forget that building an outstanding business and securing funding from a specific VC are distinct pursuits. Never let a single “no” derail your founding journey. Embrace the challenge, learn from the feedback, and keep building. Success is not solely defined by the checks you secure but by the impact you create through the relentless pursuit of your vision.

In essence, the art of pre-seed investing lies in recognizing founders who possess a unique combination of passion, adaptability, and resilience. These entrepreneurs are driven by their vision and demonstrate an uncanny ability to navigate uncertainty, making them invaluable assets in the early-stage startup ecosystem, and proving that success is ultimately measured by the tenacity to transform a compelling idea into a lasting impact.

Guest post written by Alex Wu, a Pear Fellow at Stanford.